01 Mar Mortgage Options for First-Time Multifamily Property Owners and Investors

Well into Q1 2021, mortgage rates remain near historic lows, with the average 30-year rate 1.09 percentage points below the 2019 annual average rate. With these low rates, comes a great opportunity to generate passive income and begin a long-term investment, especially if you choose a fixed-rate mortgage and lock in these low rates.

Even if you have never owned multifamily real estate, now is the time to capitalize on these rates and make your first investment. Because multifamily homes up to four units are considered residential for the purposes of financing, you can buy them with mortgages similar to those used for single family homes. Once you have more or more units in a property, you will need a commercial real estate loan.

For the purposes of today’s article, we will be addressing how you can make the most out of the low mortgage rates and invest in 2-4 unit properties. The first thing to decide if you will be an owner-occupant, meaning you plan to occupy one of the units, or investor, where all the units will be rented out. This will affect what types of mortgages you can qualify for.

Owner-Occupant Financing Options

If you are an owner-occupant, you can take advantage of FHA loans, also known as “FHA- insured financing.” Because these are government insured loans, the FHA loan is widely known as one of the best mortgages available. Traditionally, these loans are easier to qualify for, require a lower down payment, have lower closing costs and offer the lowest fixed rates.

In many cases, getting an FHA loan for a multi-unit property is just as simple as it is for a single family home. Multi-unit properties must meet FHA minimum standards and pass an FHA appraisal. Just like any property purchased under an FHA loan, your multi-unit properties will be subject to FHA minimum standards. Borrowers will find FHA down payment and credit requirements are the same for single-unit and multi-unit properties, but lender standards may vary.

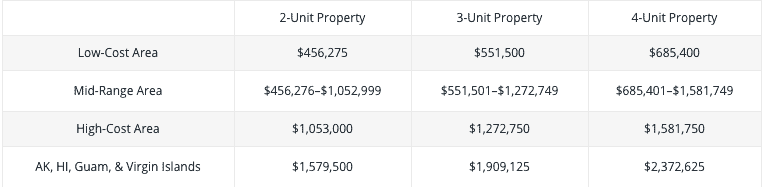

In late 2020, the FHA loan limits were increased for multifamily properties. In many high cost areas, including Orange County, the loan ceiling goes above $1.5 million for a four-unit property.

FHA Multifamily Loan Limits

Chart by The Mortgage Reports

And even better, though loan limits have increased, FHA mortgages are still available with a credit score starting at 580 and 3.5% down.

Another option you have as an owner-occupant is a VA loan. VA loans are suited for military service members, veterans and their spouses. VA lenders are likely to give you more favorable terms than you’d otherwise get with a conventional mortgage, due to the VA guarantee on a portion of the loan. These loans also offer a number of benefits including no down payment, no private mortgage insurance (PMI) and no minimum credit score. And yes, these loans can be used to finance properties with up to four units if the qualifying applicant lives in one of the units.

Investor Financing Options

Now if you don’t plan on living on the property and getting a loan as an investor, there are still good options for you. However, investors typically need a higher down payment than owner- occupants. Lenders typically assume a higher risk with investment properties and will require 20-30 percent down, depending on the rates on the offer.

One of the most common options for investor financing are Fannie Mae and Freddie Mac loans, AKA “Agency loans.” Fannie and Freddie loans typically offer high leverage levels—75% to 80% and low interest rates.

As an investor, you can use these types of loans to buy or refinance multifamily properties and both Fannie Mae and Freddie Mac have “small loan" programs with terms and pricing for investors of multifamily properties with under 50 units or under $7.5 million.

Finally, whether you are an owner-occupant or an investor, you might be able to use the projected rental income from the additional units if you are an owner-occupant, or all units if you are an investor, to qualify for your loan. Typically for these payments to be taken into account, you must already have a signed lease by the renters.

Next Steps

And the best news of all, is choosing to become a multi-family property owner does not mean you need to take on all the work of being a landlord. Everything from marketing to maintaining the property can all be taken care of by a property management team like ours! Here at Reynold Realty Advisors, we provide multifamily and commercial property owners across Southern California full management service including tenant leasing, compliance management, remodeling, finance management and more. We invite you to learn more about our services or request a free property assessment.

No Comments