31 Dec Closing 2021…

As the second year of a “new normal” comes to a close, we want to take a moment and reflect on what we, as a community and an industry, have learned, how we have grown, and what we want to carry forward into the new year.

Throughout 2021, we’ve seen our staff, investors, clients, and partners face each day with…

Creativity: If we had to choose just one trait that embodied this year, creativity would be a strong contender. We’ve truly seen “if there’s a will, there’s a way” in action throughout the past 18+ months. While we hope there’s significantly less need for creativity in the new year, we are grateful and amazed by the creative ways we’ve seen investors diversify, our property managers attract tenants, and construction adapt to changing needs. We will be channeling this creativity to always better serve our community in the days, weeks, and years to come.

Kindness: In multi-family and commercial properties, there is an inherent sense of community– after all your tenants are literally neighbors. But the new ways we have seen communities of all kinds (vendor partners, owners, and tenants) pull together and the kindness they’ve shown is nothing short of inspiring. As the world continues to change in the next year, leading with kindness is a lesson, and a practice, we will carry on.

Passion: There is no doubt that over the past year, our industry faced very difficult challenges. In addition to the regular difficult parts of the job, we’ve had to navigate eviction moratoriums and changing legislation. And through all these challenges, we’ve all worked with resilient passion. At the end of the day, passion is what drives us and, here at RRA, we are excited to enter a new year with renewed passion.

And since we are wrapping up the year, let’s take a look at some of the local market insights and opportunities for multifamily and commercial properties. (Numbers and statistics are as of Q3 2021.)

Los Angeles

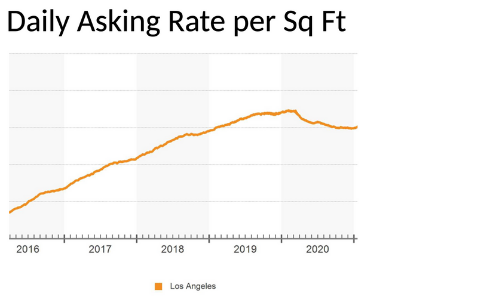

Overall, the LA market has seen a very strong recovery. There has been a steady increase year over year in rental prices. Current prices are above 2020 and even 2019 numbers. As you will see below, the daily asking rate per square foot has increased 6% since the start of the pandemic. This is a strong recovery but lags behind the 11% we saw in previous years.

Another trend we’ve seen continue to develop is the strength of the affordable housing market. Affordable housing saw less of an impact throughout COVID and has seen a faster recovery than four and five star communities. This tracks with the changes in tenants’ desire for more space between neighbors and an increased need for space as the home became an office, schoolhouse, and gym as well. The village and tower style living became less popular during the pandemic and many people gravitated to older, more spacious buildings.

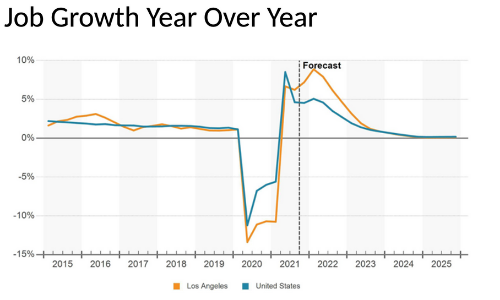

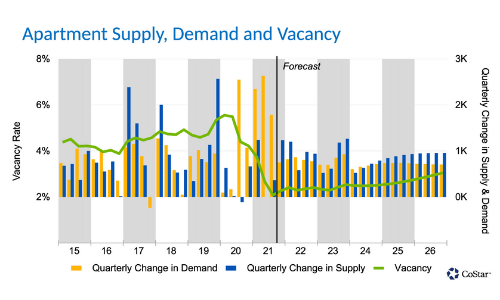

With a massive increase in job growth, in both LA and the nation, the future is looking very strong. LA is currently the second largest metropolitan market in the nation. Currently there are 25,000 new units under construction and the sales volumes of apartment properties reached $10.5 billion. In addition, the average market pricing for apartment properties, $390,000/unit as of Q3, is well above the national average of $230,000/unit.

Orange County

Vacancy rates in the OC dropped off significantly during the pandemic and are forecasted to remain lower than pre-pandemic levels in the years to come as the demand and supply gap closes. This, coupled with the prediction that Orange County employment will fully recover by Q3 2022, offers a very positive outlook for the new year.

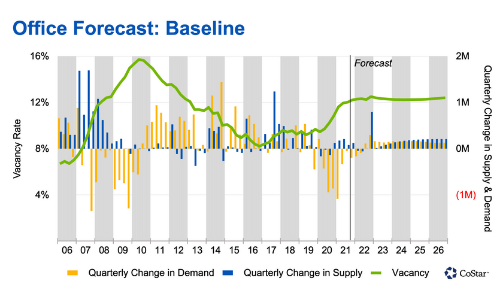

The industrial market continues to perform well, and showcase that it is a strong and consistent investment in both upward and downward markets. Currently the leasing volume is slightly lower than this time last year but more units are projected to come online soon. Over the next two years, we are expecting very high increases in demand and supply.

2021 has given us many lessons on our outlook and investments. The past two years have clearly demonstrated that when the market is down, apartments are in high demand and industrial units are consistently strong. So as we go forth into the coming years, keep in mind that multi-family and industrial properties are great, low-risk options for your portfolio. However, each investor and each portfolio has its own goals and strategies. If you are seeking guidance on your investment strategy in the new year, we would be honored to speak with you. Please contact us anytime we can be of assistance.

*Data and analysis from this article is courtesy of CoStar. This material should not be relied upon for predictions of future results but to provide you with background, information and education.

No Comments